GOOD NEWS! After prayerful consideration and many hands working behind the scenes, we are excited to announce that our online systems are new and improved to provide a greater experience for everyone. A new system allows our staff and volunteers greater efficiency and better tools to serve, care, connect, and communicate with you.

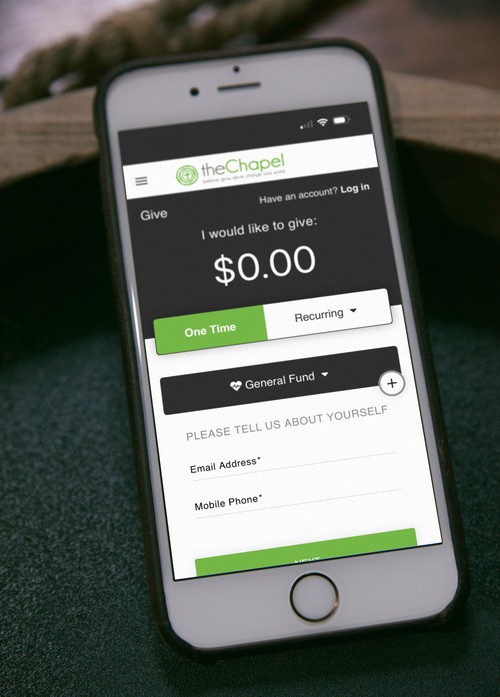

Our new online giving tool synchronizes with the rest of our database, streamlining processes for donors and staff. Thank you for all the ways you support God's mission and vision for this church. Your prayers, service, and generosity are truly changing your world!